Facebook: Personal vs. Professional

By Melissa Grindel

Social media - what once was a strictly personal space for interactions with friends and family has inevitably evolved into a bustling advertising arena, where the lines between business and personal are blurred at best. Entrepreneurs, like mortgage loan officers, are using this free advertising medium for business partner networking and marketing to consumers alike. But the common question remains - should they use their personal profiles or create a business page?

What are the Differences

Facebook created the Pages for Business feature back in 2007 in an effort to create a space for business owners to market their products or services and for consumer users to connect with those businesses. This Business Page model is commonly used by brick-and-mortar stores and restaurants where consumers might check-in, but many small businesses and lone wolves of the sales force, like mortgage loan officers, have also flocked to the Facebook for personal brand promotion. There have been many changes to both sides of the platform since then, here are some key distinctions:

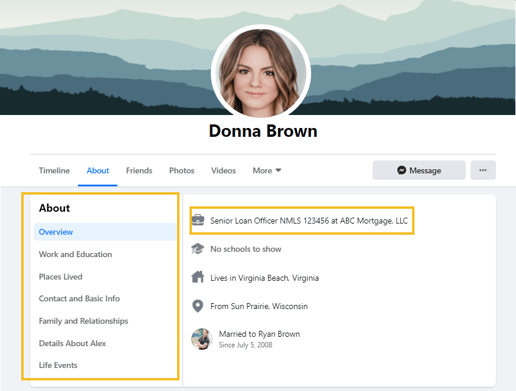

- Personal Profiles: A Facebook profile is an individual's personal account, where he or she can post updates, upload photos, share videos, maintain a friends list and provide personal information. The "Bio" section has 101 characters. Users can add Work information in a separate section. The name of the account can only be the account owners name.

- Professional Business Pages: A Facebook business page is a free web page that companies can build on Facebook to expand their internet presence & interact on a more personal level with consumers. Like a personal Facebook profile, Facebook business page can send and receive messages, post updates, get notifications, and like, comment and share other Facebook users' and pages' content. Pages allow users to include license numbers in the account name. The About section allows for up to 255 characters with an Impressum section that allows for 2,000 characters. Business Pages also allow account owners to post ads and see data Insights on how the page is performing. Friends do not automatically come over as followers from the personal profile to the business page.

Difficult to Be Compliant

Facebook personal profiles and Facebook business pages have different fields and character limitations associated. For example, Facebook personal profiles do not allow for license numbers to be added to the account name. All employer and licensing information can be added to the Work sections instead, but only Company & Position reflect in the profile Overview. To see full licensing information and disclosures, consumers would need to click through multiple fields. Also keep in mind these field must be set to "Public" to be seen in the first place.

The FTC has outlined in their .Com Disclosures Guidance that consumers should not have to click more than once to see all necessary disclosures and licensing information. This means, in order to be in compliance, all advertising posts shared on a personal profile would need to include: a full licensing disclosure, equal housing information, state by state disclosures, company specific information, and any relevant product advertising disclosures. The one-click rule is much more achievable with Business Pages where licensing information can be included in account names and additional disclosure information is readily present on the About page.

The Separation of Personal Opinion and Company Standings

We've seen it time and time again, a news story about a company employee making poor or malicious decisions on social media that have a negative effect on the companies public relations for years to come. In one story outlined in our Corporate Social Media Horror Stories article describes how one employee for a financial institution used racial slurs on her social media profile. Other social media users were able to quickly identify where the employee worked, and contacted the company directly about the inappropriate language. Though the employee was terminated, various fair lending lawsuits were then brought against the company for years to come and negative consumer reviews began to soar.

Additional Risks

Licensing and relevant disclosures are top of mind for regulators, but there are additional concerns with Facebook:

- Targeted Ads: Facebook allows for the use of paid ads where purchasers can target specific consumer groups based on collected information. Targeting options can include consumer search history, page interactions, and most concerning - demographic information. Fair lending is a huge concern for targeted ads, and more regulators are requesting this information during examinations.

- Facebook Groups & Events: Facebook allows for communication and connection among users in a variety of ways, primarily through the news "feed" or current postings of connected accounts. Users can also create private Groups, where only specific users are allowed to join. This gated content makes monitoring particularly difficult for marketing and compliance teams. Users can also create Events, such as the promotion of an open house. These features create a higher risk for RESPA Sec 8 concerns.

- Instant Messenger: Facebook allows users to contact each other privately using the Instant Messenger functionality. Consumers may use this functionality to contact a loan officer directly to inquire about a loan product or service. Loan officers should be mindful to re-route conversations with consumers into an approved communication channel, such as email, to ensure no personal consumer information is disclosed through an unsecured portal.

- Consume Privacy & PII: Loan officers should be mindful of all aspects of consumer privacy on social media, including photos of borrowers and personally identifiable information shared on posts. A photo release form may be utilized to minimize risk. All personally identifiable information (PII) should be solicited through a secure portal. Tools like Google Doc's, SurveyMonkey, etc. should not be utilized.

The Takeaways

Social media use in the mortgage world feels a lot like the wild west. Compliance and marketing teams have so much on their docket that it can be difficult to devote time to discovering and remediating issues on their own. When possible, a best practice is to ensure employees are using professional pages when doing any product advertising or self promotion. Marketing departments can create business pages for individual loan officers, some electing to add themselves as administrators. Loan officers gain insightful metrics about consumer interactions with their online presence and compliance teams rest easy knowing that consumers and regulators alike see all the necessary licensing and disclosures.

Related Posts

Why Loan Officers Should Use Professional Pages on Social Media

Social media has been such a big part of our personal lives for the past 10 years. The number of...

Facebook's New Business Pages & What That Means for Compliance

In 2007, Facebook began the rollout of the now well-known Business Page model, allowing businesses...