Why Loan Officers Should Use Professional Pages on Social Media

By Melissa Grindel

Published on October 28, 2020

Social media has been such a big part of our personal lives for the past 10 years. The number of social media network users worldwide has increased over 300% since 2010. But social media use is no longer isolated to our personal lives, and is commonly utilized by entrepreneurs, like mortgage loan officers, for business partner networking and advertisement to consumers. The line between professional and personal is further blurred when loan officers advertise out of their personal profiles, a common practice with potential for disaster.

The Separation of Personal Opinion and Company Standings

We've seen it time and time again, a news story about a company employee making poor or malicious decisions on social media that have a negative effect on the companies public relations for years to come. In one story outlined in our Corporate Social Media Horror Stories article describes how one employee for a financial institution used racial slurs on her social media profile. Other social media users were able to quickly identify where the employee worked, and contacted the company directly about the inappropriate language. Though the employee was terminated, various fair lending lawsuits were then brought against the company and negative reviews began to soar.

The Terms of (Mortgage) Service

In efforts to discourage corporate user-to-user business marketing plots, Facebook created the Facebook Page/Business Page option for entrepreneurs and businesses alike. The Facebook Page option comes with loads of added benefits, like: low-cost marketing efforts through PPC campaigns, customer support tools, consumer data analytics, and geotrafficing for more targeted ads. In the golden age of data analytics, loan officers should be utilizing these tools to improve both individual and company brand awareness.

What a Regulator Can't See, Can Hurt You

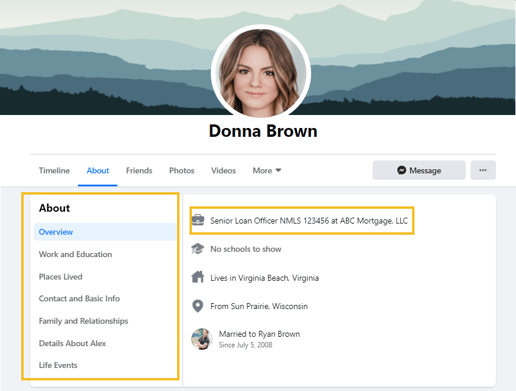

Scenario: a regulator is preparing to audit your company. One portion of the audit is tied directly to your loan officer social media presence. The regulator simply types your company name into the social media search bar to see what fish he will catch today. Your top producer pops up, with your business name listed on his work bio. Based on privacy settings, the About section isn't available to the regulator, but the loan officers most recent photos are, and that's where the self promotion is most evident. Simply, the regulator sees mortgage advertisement under your company name, but does not see the required licensing numbers, the appropriate disclosures, or a link to your application portal. You'll likely get an email with these findings soon.

There are many different scenarios that could be played out, but the major takeaway is the same: personal profiles are not suitable for regulated industries like the mortgage business, and to try and update personal profiles and their various privacy settings to ensure compliance is a task too daunting for even the most dedicated compliance departments.

Automation Can't be of Service

Social media was originally designed to be a safe space, where users could interact with social groups, share photos of their animals, and announce big life updates. Before long, businesses saw an opportunity to use the information on a users profile for ad targeting, and it discouraged users from participating in the platform altogether.

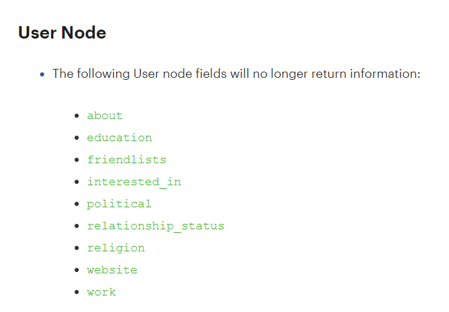

To curb this issue, platforms like Facebook and Instagram have taken further steps to protect user profile privacy and have restricted the communications between user platform data and businesses. These restrictions, as outlined in Facebook Developer Documents, show what information businesses can and can't pull from the Facebook API, or Application Programming Interface. This means that social media compliance software cannot monitor or evaluate personal profiles for the below profile section information:

How Can I Get My Loan Officers Onboard?

Social media use in the mortgage world feels a lot like the wild west. Cowboys, loan officers, roam without much restriction or guidance and sheriffs, compliance and marketing teams, have so much on their docket that it can be difficult to devote time to discovering and remediating issues on their own. So how can companies wrangle in compliance?

The answer? Start clean: ensure employees are using professional pages when doing any product advertising or self promotion. Employees can copy and convert their existing profiles into professional pages in just a few short steps (check out our articles on Converting Facebook Profiles and Converting Instagram Profiles for step by step instruction). Alternatively, marketing departments can elect to create business pages for individual LOs. This allows marketing departments to add themselves as page administrators to ensure compliance from the get-go and for a continuing basis. When executing these changes, make sure employees remove all instances of advertising and self promotion from their personal profile as well.

Related Posts

Facebook: Personal vs. Professional

Social media - what once was a strictly personal space for interactions with friends and family has...

The Mortgage Compliance Dangers of Alignable

Social media is a free tool utilized by millions of sales folks worldwide to promote brand...